The option of a mortgage or a loan is a wise one since it enables the borrower to catch lower interest rates, pay lesser interest, or combine debts.

In this case, it is important for Norwegians intending to have the best of their positions financially to familiarize themselves with the refinancing process. This guide will describe what refinancing is, the best time to refinance, and how to do so properly but it will not highlight certain firms or banks.

Refinancing is the process of paying off one loan with another of a different character. This may be for any of the loans such as home loans, car loans, and the common personal loans.

The most common reason for refinancing is to attain better interest rates and this brings about a big difference with the expenses throughout the existence of the particular personal loan. But refinancing is also functional in altering the term of a loan, moving from adjustable rate mortgage to the fixed rate one, or to get home equity.

This comprehensive guide can help you manage your finances more effectively by exploring the best loans to pay off debt, lower interest rates, and regain financial stability.

Benefits of Refinancing

This one is a big favorite and is one of the main reasons why so many homeowners choose to refinance – lower interest rates. In a low interest rate regime, refinancing enables one to reduce the monthly installments and also the total interest amount. Further, refinancing can improve with an ability to reduce a loan’s maturity and let borrowers work to pay off their loans more efficiently at lesser interest rates.

The other benefit is that a person can combine several debts and take a loan in the amount sufficient for paying all the creditors. This can make finances easier because several payments can be rolled into one and at a lower interest rate.

Refinancing can also be beneficial by utilizing a variable interest rate loan and obtaining a fixed interest rate loan, regardless of fluctuating interest rate, the monthly payments will always remain constant. You can visit this helpful site for news about the interest rate in Norway.

The Refinancing Process

There are different stages which are characteristic of the refinancing process. The first step therefore, is to evaluate the overall financial position because it will help in defining the refinancing objectives. Regardless of the reason or goal it is always advisable to have an objective when refinancing, whether it is interest rate reduction, monthly installment decrease or change of the loan schedule.

Second, one needs to submit all the documents that are associated with personal finance, including income statements, tax returns, and information about the existing loan. These will be needed when you fill a refinancing application and will assist the lenders in determining whether to finance you or not.

Some banks will list the documents needed online. You can check their site or call and inquire as to what you might need. This will save you time in the long run because it allows you to be prepared to complete the process in one session.

Evaluating Your Current Loan

Hence, before engaging in a refinancing process, ensure that you analyze your existing loan carefully. What is left to consider is the duration of the term, the interest rate, and all such matters as prepayment penalties that may accompany it.

It’s these little details that will enable you to decide whether refinancing will be of benefit to you or not.

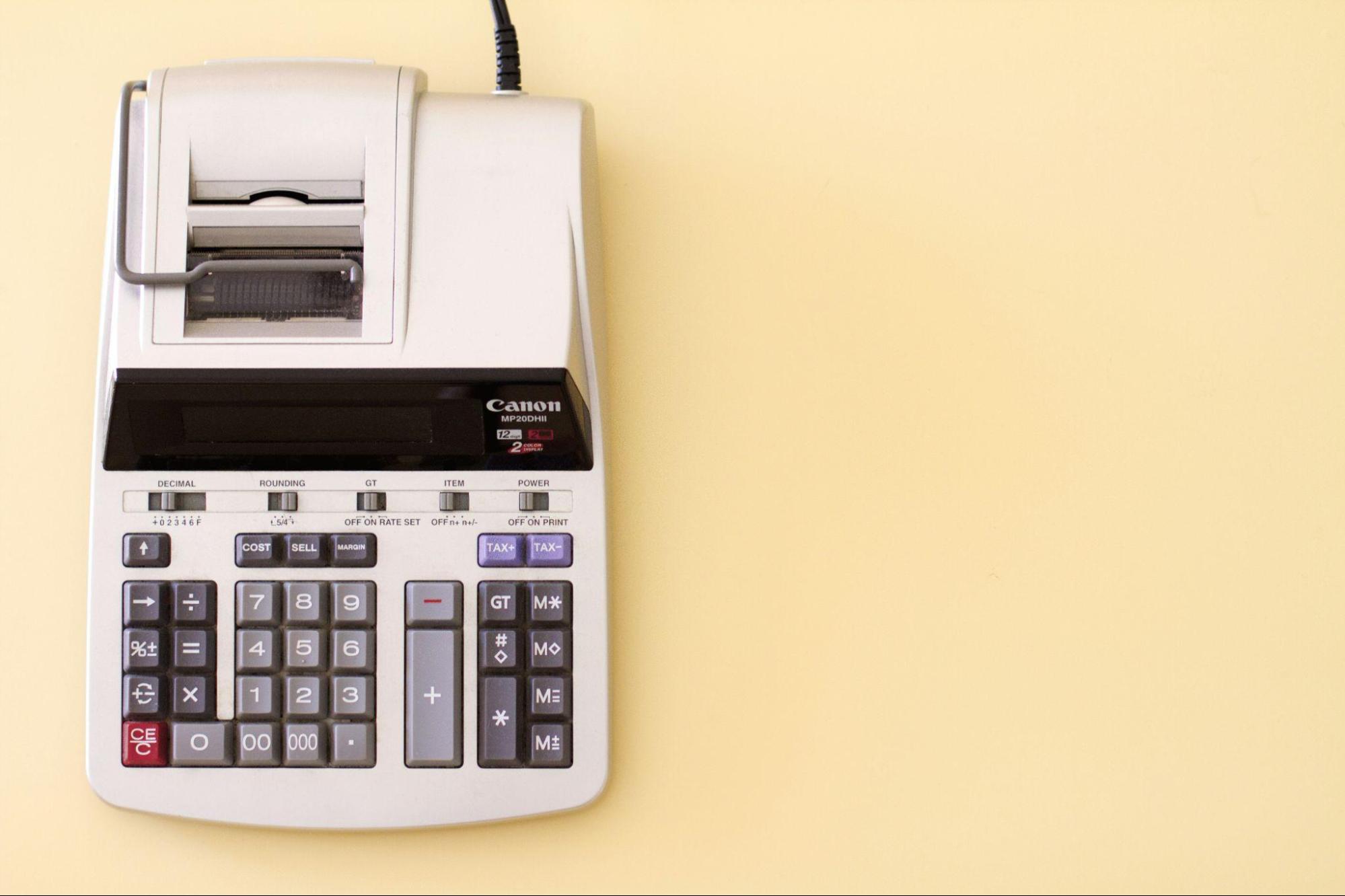

To make this assessment easier and more accurate, using a business loan calculator can help you estimate savings and determine the break-even point-when the relatively small savings have covered all the hassle of refinancing.

Use the following formula in order to determine break-even, which is when the relatively small savings will have covered all the hassle of refinancing: This will help you paint a picture of what benefits you can expect from getting a degree.

The Best Rates and the Shopping That Goes With Them

Obtaining the best refinancing has to involve a good amount of research. First of all, it is necessary to research various lenders and compare the available options. The use of online comparison sites is also useful when one wants to compare the interest rate as well as the terms offered by different lenders.

For borrowers who prefer personalized guidance, consulting experienced professionals such as Bradley Nuttall the financial advisers in Christchurch can also help clarify refinancing options and long-term financial strategies.

Keep this in mind: often a difference of 0.25% on the interest rate corresponds to thousands of dollars in savings per year.

In rate comparison, look at the Annual Percentage Rate (APR) which is the actual interest charge and costs related to the loan. This will give a more holistic approach in arriving at the total cost of refinancing.

Preparing for the Application

Once you’ve chosen the creditor with the best rates, prepare for the procedure. This is usually done by completing a form and providing the necessary financial records such as the financial statements.

This basically means applicants should be ready to produce some information about their income, employment and credit history. This information will be used by the lenders in evaluating the credit worthiness of the applicants and ration the new loan in the required credit standards.

The Approval Process

When you apply for the loan, the lender then evaluates your application based on your financial records to determine if you qualify for a loan modification. This may involve a credit check and a detailed analysis and assessment of your credit records.

A credit check will reveal your credit score. A credit score is a numerical figure that wraps up an individual’s credit history, and which is used to determine the creditworthiness of an individual. This is the same case with Norway as with most other countries because the credit score is determined by several significant aspects.

The most prominent factor is the aspect of punctuality and timeliness of the payments made on loans as well as the bills. The two main points that should be accounted for are the quantity of debt currently and credit card balances and loans.

The length of credit history is also considered and where the credit history is long, tends to push the score up. Also, carefully balance the ratio of the credit types and their utilization rate; it can be affected by mortgages, car loans, credit cards, among others.

Finally, recent credit inquiries that can be viewed as an application for new credit reduces it temporarily also. Keeping a good credit score is a good record of handling credit and should include proper management and timely payment of the bills as well.

If approved the new loan offer with its terms will be submitted to you by the lender. Take the time to review these terms to make sure they are conducive for the refinance that you have in mind.

Closing the Loan

The last of the refinancing process is called the loan closing. This comprises executing the fresh loan agreement as well as the costs of closing the new loan agreement. Such expenses may include the expenses on appraisals, on the legal services, and on the various administrative charges. Sites like https://www.billigeforbrukslån.no/refinansiering/ can help you determine these charges. These are costs that need to be included in the cost of refinancing to check whether the whole process is economically possible.

Post-Refinancing Considerations

Despite many benefits of refinancing, you have to be cautious of your financial status after completing the process. Stay alert on interest rates and is ready to re-finance again if the chances present themselves. Also, do not forget about credit scores and act financially sound in order to take more benefits from the refinancing in the future.

Potential Pitfalls of Refinancing

Hence even though refinancing has numerous advantages, it is not without its vices. A typical mistake is to decide on the loan on the basis of the amount of interest charged more than the total cost of the borrowed sum. Always agree on the amount of charges involved in the refinancing process and consider all the charges in your decision making process.

One more problem which may be faced is linked to the choice of long loan term, as it will make a borrower pay more for the interest. Before changing any of the mentioned loan term, need to think carefully on the favorable and disadvantageous impact and compare them with the future plans.

Refinancing for the Norwegians is one of the useful tools that can be used to improve the leverages. This way, you can make sound decisions, considering the process of the loan evaluation, as well as comparing different rates to gain substantial benefits.

Refinancing provides the way out for all such people who need to achieve quantitative changes in their interest rates, monthly payments or amount of debt. Engage in research, be prepared and do whatever it takes to make your refinancing a success.

I’m Isabella Garcia, a WordPress developer and plugin expert. Helping others build powerful websites using WordPress tools and plugins is my specialty.